Navigating the Medicare Maze: Why Dave Ramsey and AARP Are Sounding the Alarm

Share- Nishadil

- January 07, 2026

- 0 Comments

- 3 minutes read

- 54 Views

Medicare Open Enrollment: Red Flags from Financial Guru Dave Ramsey and AARP You Can't Afford to Miss

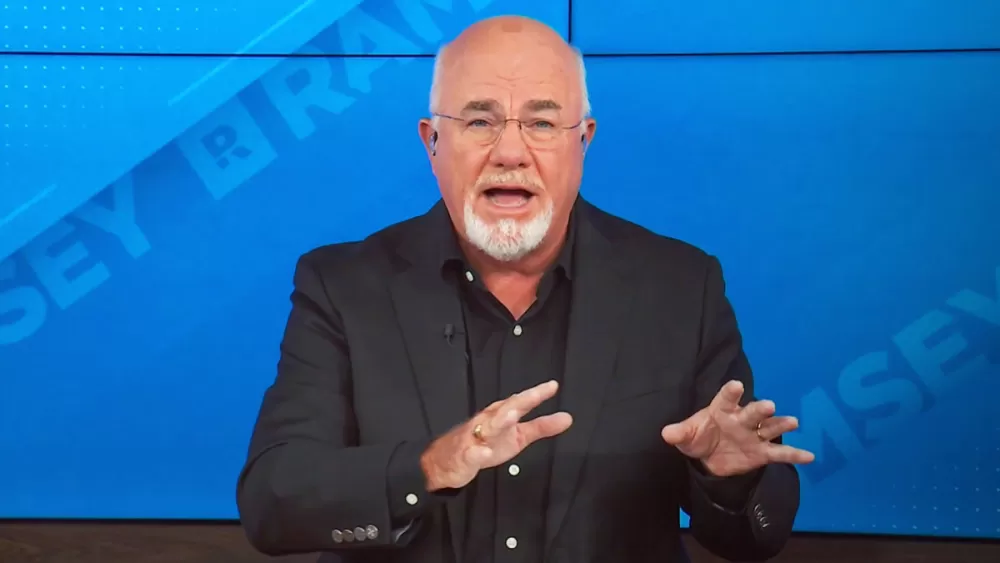

As Medicare open enrollment approaches, both Dave Ramsey and AARP are raising serious concerns, urging seniors to be incredibly cautious about their healthcare choices, especially when it comes to Medicare Advantage plans.

Alright, let's talk about something that touches nearly all of us, especially as we get a little older: Medicare. It’s open enrollment season right now, and for many, it feels less like an opportunity and more like wading through a thick, confusing fog. With countless ads bombarding us, touting this plan and that benefit, it's easy to get lost. But here's the kicker: two really influential voices, financial guru Dave Ramsey and the venerable AARP, are both waving big, red flags. And when they both agree on something this important, well, you really ought to pay attention.

See, the big confusion often boils down to this: Original Medicare versus Medicare Advantage. On one side, you have the government-run, traditional Medicare, which many supplement with a Medigap policy and a prescription drug plan. It’s pretty straightforward. Then, there's Medicare Advantage, run by private insurance companies, which bundles everything into one plan, often promising extra perks like vision or dental. Sounds great, right? Sometimes it is, but sometimes, as Ramsey and AARP suggest, it's anything but.

Dave Ramsey, bless his direct, no-nonsense heart, has never been shy about calling out what he sees as overly complicated or potentially deceptive financial products. For him, the Medicare Advantage system often smacks of a classic 'bait and switch.' You sign up, perhaps lured by zero-dollar premiums or a shiny new gym membership, only to find out later that your network of doctors is severely limited, or getting approval for certain procedures becomes a frustrating uphill battle. He often advises sticking with Original Medicare, paired with a solid Medigap plan, because it offers simplicity and broad access without all the extra hoops. It’s about clarity and avoiding surprises, especially when your health is on the line.

Then we have AARP, a massive advocacy group for older Americans, and they've actually compiled a 'Dirty Dozen' list of healthcare scams. That’s pretty serious! While not exclusively about Medicare Advantage, their warnings frequently touch upon the aggressive and sometimes misleading marketing tactics employed by these private plans. They highlight concerns like networks that shrink, pre-authorization requirements that delay necessary care, and claims that get denied, leaving beneficiaries scrambling. For AARP, it's about making sure seniors are protected and fully informed, not just enticed by flashy promises.

Think about it: the idea of a 'switch and bait' isn't just a marketing ploy in some abstract world; it can have real, tangible impacts on your healthcare. Imagine needing a specific specialist, only to discover your new Advantage plan doesn't cover them, or requires endless paperwork to even consider it. These plans can certainly work well for some folks, absolutely, but the key is to understand the potential downsides before you commit. It's not always about what's offered upfront, but what's hidden in the fine print.

So, what's the takeaway here? Don't rush. Don't let those incessant ads push you into a decision you might regret. Do your homework, really dig into the details of any plan you're considering. Talk to trusted advisors, compare Original Medicare with Medigap options versus various Medicare Advantage plans. Understand their provider networks, their authorization processes, and critically, their out-of-pocket maximums. Your health, and your peace of mind in retirement, are far too important to leave to chance. Take the time to make an informed choice; Dave Ramsey and AARP are essentially begging you to.

- Health

- UnitedStatesOfAmerica

- Business

- News

- BusinessNews

- Healthcare

- HealthInsurance

- PersonalFinance

- Retirement

- Medicare

- FinancialPlanning

- MedicareAdvantage

- DaveRamsey

- Medigap

- SeniorHealthInsurance

- HealthcareChoices

- MedicareOpenEnrollment

- RetirementHealthcare

- DaveRamseyMedicare

- AarpMedicare

- MedicareScams

Disclaimer: This article was generated in part using artificial intelligence and may contain errors or omissions. The content is provided for informational purposes only and does not constitute professional advice. We makes no representations or warranties regarding its accuracy, completeness, or reliability. Readers are advised to verify the information independently before relying on