Albertans most concerned about ability to repay debts: consumer debt index

- Nishadil

- January 09, 2024

- 0 Comments

- 5 minutes read

- 57 Views

- Save

- Follow Topic

Albertans most concerned about ability to repay debts: consumer debt index

According to a consumer debt index published by debt insolvency trustees at MNP, Albertans are also the most likely in Canada to be concerned about their level of debt.

More Albertans are expressing concerns about their ability to repay their debts, with more than seven in 10 concerned over their ability to repay what they owe, eight percentage points above the national average and the highest among provinces. And according to the latest consumer debt index published by debt insolvency trustees at MNP, Albertans are also the most likely in Canada to be concerned about their level of debt.

This quarter, half of Albertans were concerned about how much debt they were carrying. MNP licensed insolvency trustee Donna Carson compared credit spending to a “lifeline” as Albertans deal with rising costs. “Most necessities cost more, and the cost of repaying debt has increased. This fosters a growing sense of concern about debt repayment and managing day to day expenses,” Carson said.

1:58 The #1 thing to consider as you make your money related New Year’s resolutions “The culmination of holiday bills, impending mortgage renewals, and ongoing expense hikes paints a concerning picture. Many Albertans might be nearing a critical juncture, grappling with both financial and mental strain.” Story continues below advertisement Nearly one third of Albertans said the last quarter year has negatively impacted their ability to deal with a one per cent increase in interest rates.

That result increased to 37 per cent when asked about their ability to take on an extra $130 in debt payments as a result of increased interest rates. Only 17 per cent of respondents say their ability to absorb the $130 has improved, a number that hadn’t changed from last quarter. Get the latest National news.

Sent to your email, every day. But Albertans appear to have worked to improve their debt situations, with three per cent fewer respondents saying their debt situation has worsened and four per cent more saying it’s improved in the last year. A similar trend is seen when Albertans were asked to look back five years.

Carson said while many households made efforts to manage their finances and adjust to increasing interest rates, not everyone has made that kind of progress. Story continues below advertisement “Albertans who are already stretched thin may find themselves accumulating further debt just to meet basic needs as living expenses increase.

They are trying to fill a hole by digging a new one — a situation that can have a disastrous impact on their finances.” One in five Albertans told MNP they needed to take money from savings, home equity or RSPs or use alternative methods to pay debt or for day to day expenses in the past year. Albertans are the most likely in the country to say they’ve only made the minimum credit card payments in the past quarter at 33 per cent.

Finances have been impacting mental health in the province, with 59 per cent of Albertans saying it’s caused them anxiety, 57 per cent saying it’s caused them stress and 51 per cent saying their finances have cause a greater sense of isolation. 4:39 How to start paying down debt Trending Now Golden Globes 2024 winners list: ‘Oppenheimer’ and ‘Poor Things’ top the night A major storm is headed to southern Ontario.

Here’s what to expect More than two in five Albertans – 42 per cent – say they’re embarrassed by the size of their debt and 35 per cent admit to hiding their credit card debt from friends and family. Story continues below advertisement “Financial security and preparedness support a person’s overall well being.

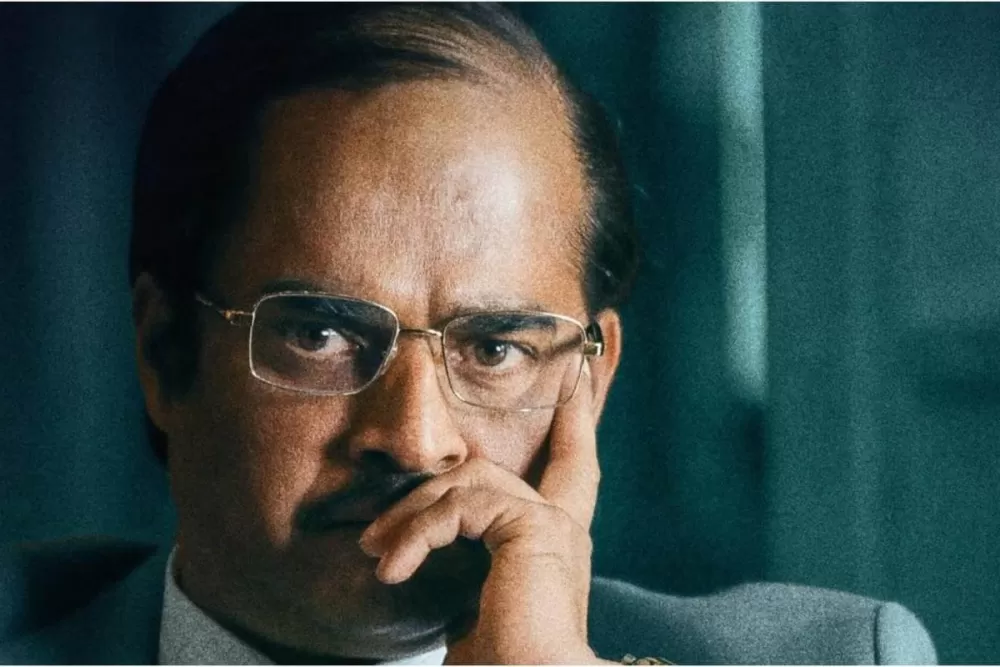

Those facing financial turmoil should seek help, the same way someone facing a health crisis would seek help,” Carson said. Samir Kayande, Opposition critic for fiscal responsibility, said the consumer debt index numbers are “heartbreaking.” “Albertans have trailed other Canadians with the lowest wage growth of any province since the UCP was elected in 2019.

Now, Albertans are struggling with personal debt more than any other province with 71 per cent of Albertans living in fear of not being able to pay their debts,” Kayande said in a statement. “The UCP’s response to the affordability crisis has been to gamble with Albertans retirement security and revoke the tax cuts that they promised.

It’s unacceptable. “If this report doesn’t serve as a wakeup call to Danielle Smith and the UCP, I don’t know what will.” 3:12 Financial advisor on cutting costs, reducing debt and spending Global News asked the Alberta government for comment on the latest consumer debt index results, which will be added to this story when it’s received.

Story continues below advertisement MNP’s latest consumer debt index across the country reached its second lowest point since it started measuring debt sentiment in mid 2017. Nationwide, 63 per cent of people are concerned about their ability to repay their debts and 47 per cent both regret the amount of debt they’ve taken on and are concerned about their levels of debt.

More on Lifestyle United finds loose bolts on Boeing 737 Max 9s after Alaska Airlines incident Canada issues warning as Florida plan to import drugs raises fears Air Transat, union agree on new tentative deal for flight attendants Honda considers $14 billion plan for EV production in Canada.

Disclaimer: This article was generated in part using artificial intelligence and may contain errors or omissions. The content is provided for informational purposes only and does not constitute professional advice. We makes no representations or warranties regarding its accuracy, completeness, or reliability. Readers are advised to verify the information independently before relying on