Jim Cramer Declares JPMorgan's Latest Move 'Monumental' for Bank Stocks

Share- Nishadil

- September 17, 2025

- 0 Comments

- 2 minutes read

- 51 Views

Cramer: JPMorgan's Recent Performance Marks a 'Monumental' Shift for Financial Sector

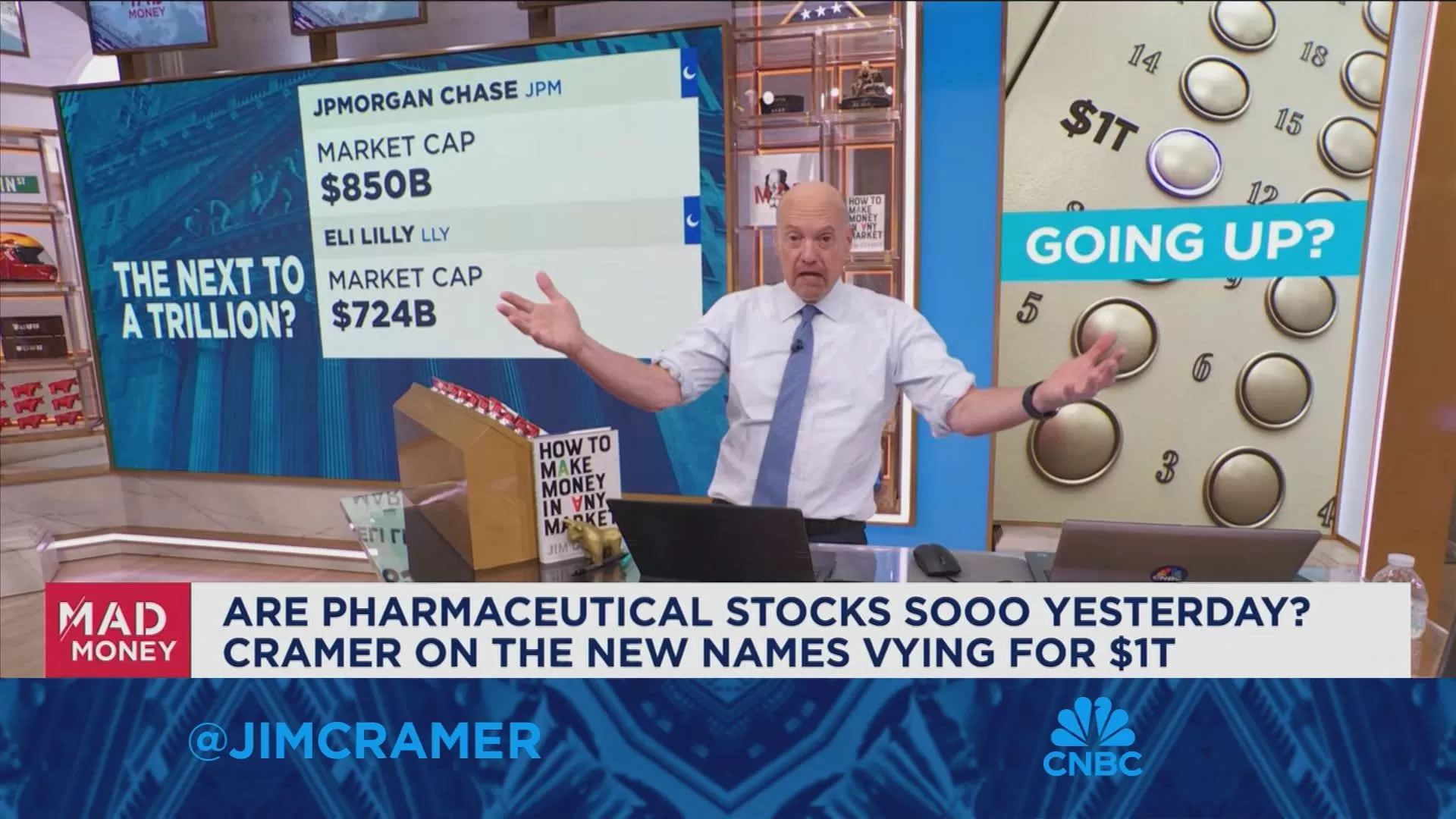

Financial expert Jim Cramer expresses extreme bullishness on JPMorgan Chase, asserting that a recent development is a game-changer for the entire banking industry, setting a new benchmark.

In a powerful and unequivocal declaration, CNBC's Jim Cramer has spotlighted JPMorgan Chase, hailing a recent development within the banking giant as nothing short of 'monumental' for the entire financial sector. Cramer, known for his often passionate and always direct market insights, emphasized that this particular 'move' by JPMorgan isn't just a win for the institution itself, but a profound signal for the broader landscape of bank stocks.

What could elicit such a strong pronouncement from the 'Mad Money' host? While the specifics of the 'move' weren't explicitly detailed, Cramer's past commentary suggests a focus on fundamental strength: robust earnings that defy economic headwinds, astute strategic decisions that solidify market leadership, or an unparalleled resilience in navigating complex financial environments.

JPMorgan, under its consistent leadership, has repeatedly demonstrated its ability to thrive across diverse economic cycles, leveraging its diversified revenue streams from consumer banking, investment banking, asset management, and commercial banking.

Cramer's 'monumental' descriptor often points to a confluence of factors.

It could signify a quarter of unexpectedly strong profitability, driven by disciplined cost management and surging demand for its services. It might also refer to a strategic acquisition or a technological leap that positions JPMorgan even further ahead of its peers, consolidating its dominant market share and enhancing its operational efficiencies.

Furthermore, its formidable capital reserves and prudent risk management practices often give it an edge, allowing it to withstand market volatility that might cripple smaller, less established institutions.

For investors, Cramer's endorsement is a clarion call to re-evaluate bank stocks, with JPMorgan serving as the undeniable bellwether.

He frequently champions companies with strong balance sheets, clear growth trajectories, and management teams that execute flawlessly. This 'monumental' move, according to Cramer, isn't just a fleeting moment but a testament to JPMorgan's enduring strength and its role as a bedrock of the American financial system.

The implications extend beyond JPM itself.

If the largest bank is demonstrating such pivotal strength, it often suggests a healthier underlying economy or at least a financial sector capable of outperforming expectations. Cramer's analysis encourages investors to look closely at what makes JPMorgan so resilient and consider how those qualities might be reflected, albeit to varying degrees, in other well-managed financial institutions.

Ultimately, his message is clear: JPMorgan is not just performing well; it's setting a new benchmark for what's possible in the banking world, making its recent trajectory an essential observation for anyone invested in the market.

.Disclaimer: This article was generated in part using artificial intelligence and may contain errors or omissions. The content is provided for informational purposes only and does not constitute professional advice. We makes no representations or warranties regarding its accuracy, completeness, or reliability. Readers are advised to verify the information independently before relying on