DeFi Technologies' Valour Breaks All Records with Staggering $560 Million Inflows in 2025, Signaling a New Era for Digital Asset Investment

Share- Nishadil

- January 13, 2026

- 0 Comments

- 3 minutes read

- 25 Views

Valour ETPs Take Flight: DeFi Technologies Celebrates Phenomenal $560 Million Net Inflows, Cementing Leadership in the Digital Asset Arena

DeFi Technologies, through its subsidiary Valour, announced record-breaking net inflows of $560 million USD in 2025, demonstrating powerful investor confidence and validating its strategic approach to the rapidly expanding digital asset ETP market.

Well, folks, sometimes the numbers just speak for themselves, don't they? And in the world of digital assets, DeFi Technologies, through its innovative subsidiary Valour, has certainly given us something remarkable to talk about. We're looking at an absolutely monumental achievement: a staggering $560 million USD in net inflows for their Valour suite of Exchange Traded Products (ETPs) throughout 2025. This isn't just a good year; it's a truly phenomenal one, a clear signal that something significant is shifting in how investors are approaching the crypto space.

Think about it for a moment: half a billion dollars plus, flowing into these digital asset ETPs. It's a testament, really, to the growing trust and demand from institutional and individual investors alike for regulated, transparent, and easy-to-access avenues into the world of decentralized finance. This surge in capital pushed Valour's Assets Under Management (AUM) to an impressive $1.7 billion USD by the close of 2025, solidifying their position as a dominant player, especially across the European market.

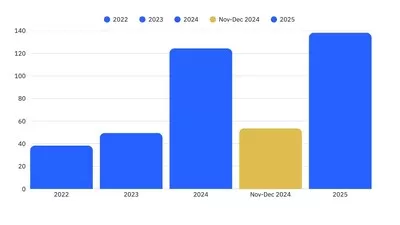

What makes this even more compelling is the trajectory. This isn't some flash-in-the-pan success. The 2025 figure of $560 million USD represents a significant leap from the already respectable $230 million USD in net inflows recorded in 2024. That kind of consistent, accelerating growth tells us that Valour's strategy – focusing on a diverse range of products, keeping fees competitive, and maintaining an unwavering commitment to regulatory compliance – is truly resonating with the market. They've built a bridge, so to speak, between traditional finance and the exciting, often complex, realm of DeFi.

Olivier Roussy Newton, the CEO of DeFi Technologies, couldn't have put it better. He emphasized that these record inflows aren't just about the money; they're a powerful validation of their core business strategy. It showcases the incredible product-market fit Valour has achieved and, crucially, highlights the surging investor confidence in their digital asset ETPs. He spoke about the team's dedication to innovation and excellence, a sentiment that clearly translates into tangible results.

And it's not just the top brass who are seeing this success firsthand. Marco Infante, Valour's Chief Sales Officer, shared his enthusiasm for what 2025 brought. He noted the strong investor interest in their diversified offerings, which span everything from foundational cryptocurrencies like Bitcoin and Ethereum to newer, high-potential assets like Solana. He also pointed out that their ETPs aren't just attracting new capital; they're proving to be a sticky investment, indicating long-term belief in the digital asset space and Valour's ability to provide secure, regulated exposure.

Looking ahead, the message from DeFi Technologies is clear: they're just getting started. This momentum, these record inflows, they're not merely a capstone on a successful year. Instead, they serve as a powerful springboard for continued growth and innovation. As the digital asset landscape continues to evolve, companies like Valour, backed by the strategic vision of DeFi Technologies, are poised to lead the charge, making the future of finance accessible to a broader audience than ever before.

Disclaimer: This article was generated in part using artificial intelligence and may contain errors or omissions. The content is provided for informational purposes only and does not constitute professional advice. We makes no representations or warranties regarding its accuracy, completeness, or reliability. Readers are advised to verify the information independently before relying on