A Clear Horizon for India's IT Firms: Tax Chief Promises Swift Resolution and Certainty

- Nishadil

- February 05, 2026

- 0 Comments

- 3 minutes read

- 24 Views

- Save

- Follow Topic

Tax Clarity on the Horizon: CBDT Chairman Vows Quick APA Resolution for IT Firms Outside Safe Harbour

India's top tax official assures over 100 IT firms operating outside the 'safe harbour' regime that their Advance Pricing Agreements will be finalized within two years, offering much-needed certainty and reducing compliance burdens.

Imagine being an IT firm here in India, constantly navigating the intricate world of tax regulations. For many, especially those dealing with international transactions, transfer pricing rules can feel like a labyrinth. Well, there's some genuinely good news coming straight from the top, offering a significant sigh of relief for a select group of these companies.

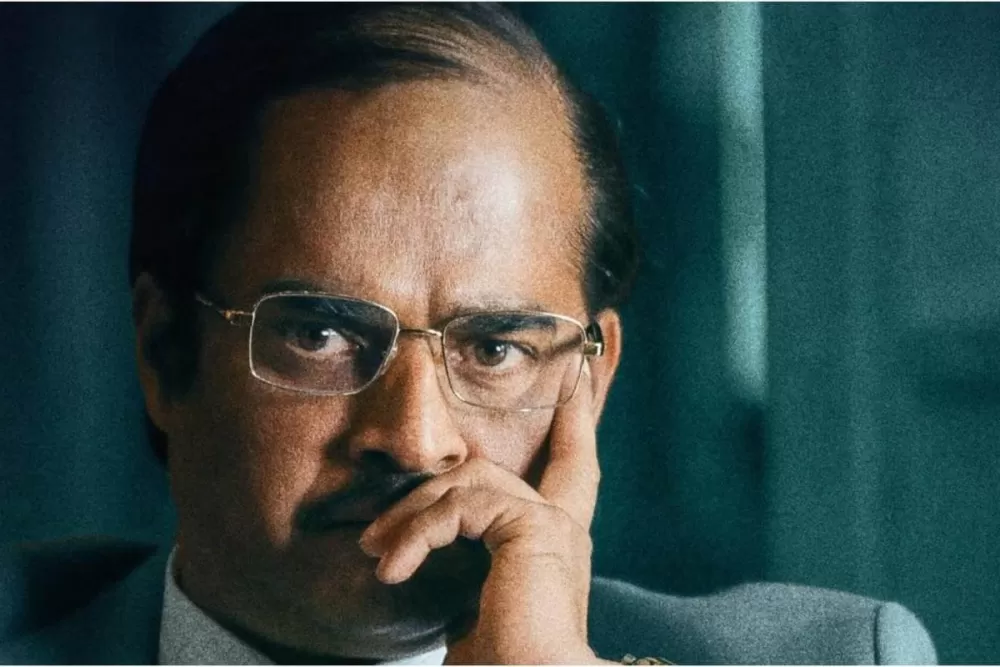

Nitin Gupta, the Chairman of the Central Board of Direct Taxes (CBDT), has made a crucial assurance: only about 100 IT firms currently find themselves operating outside the 'safe harbour' provisions when it comes to transfer pricing. And here's the kicker – he's promised that Advance Pricing Agreements (APAs) for these very firms will be wrapped up and finalized within a neat two-year timeframe. That's a pretty strong commitment, isn't it?

Now, you might be wondering, what exactly are these 'safe harbour' rules? Think of them as pre-approved, simplified guidelines for certain types of international transactions, particularly for IT and IT-enabled services. They were introduced, first in 2013 and then revised in 2016, specifically to cut down on those pesky transfer pricing disputes and make life a bit easier for businesses. By sticking to these prescribed margins, companies could theoretically bypass a lot of the usual compliance hassle and potential litigation. It’s a bit like a standard package deal; great for many, but not quite fitting for every unique situation.

And that's precisely why some firms choose not to opt for the safe harbour. The pre-defined margins, while simplifying things, might not always align with a company's actual operational realities or its specific business model. For these firms, a 'one-size-fits-all' approach just doesn't quite cut it, and they seek more tailored solutions.

This is where the Advance Pricing Agreements (APAs) step in, offering that bespoke solution. An APA is essentially an agreement between a taxpayer and the tax authority, like the CBDT, to determine an appropriate transfer pricing methodology for a company's future international transactions. It's a fantastic tool because it brings immense certainty, locking in how a company's cross-border dealings will be taxed for years to come. No more guesswork, no more last-minute surprises, and significantly less risk of future tax litigation. It really brings a sense of predictability, which is gold in the business world.

It's worth noting that India has quite a robust track record with APAs. Since the program kicked off in 2012, the country has successfully signed over 600 bilateral APAs and more than 1,500 unilateral ones. This strong history certainly lends credibility to Chairman Gupta's promise, suggesting that the machinery is well-oiled and capable of delivering on this commitment for the remaining IT firms.

Ultimately, this move is all about fostering a more business-friendly environment. By providing clear, pre-agreed tax positions, the government is aiming to enhance the ease of doing business in India, reduce the burden of tax litigation, and offer that much-coveted certainty to companies. For those 100 IT firms, this assurance means they can focus less on tax anxieties and more on innovation and growth, knowing their tax landscape is becoming clearer by the day.

Disclaimer: This article was generated in part using artificial intelligence and may contain errors or omissions. The content is provided for informational purposes only and does not constitute professional advice. We makes no representations or warranties regarding its accuracy, completeness, or reliability. Readers are advised to verify the information independently before relying on